DeFi Lending and Credit Markets: In Search of Yields

14 Dec 2021 at 14:00 EST

Crypto credit markets offer an alternative for investors seeking yields. So what are some of the opportunities?

Traditional financial credit markets offer interest rates for lenders and the much-needed ability for borrowers to access capital.

Today, US treasury-backed securities, offering the baseline of a risk-free rate of return, set the standard for lending across global financial markets.

The problem — at least $16 trillion in bonds were negative-yielding as of September 2021, or approximately 1/5 of global bond markets.

The average savings account yields 0.06% in the US, with some as high as 0.5%.

What can investors do to seek yield during a time when the CPI inflation rate was recently recorded as 6.8% in November 2021, the highest surge since 1982?

One can imagine the market forces behind the development of alternative credit markets — as are happening in crypto and decentralized finance (DeFi) — given the desire for yield amongst all types of investors who are now seeking it in alternative asset classes.

One major asset class in which investors are seeking yields is the crypto ecosystem, both on centralized finance (CeFi) platforms such as BlockFi, Celsius, and Voyager, as well as on DeFi platforms such as Maker and Compound.

As of December 2021, lending interest rates in crypto can range from 4-10% on various platforms across the crypto economy for all types of collateral, ranging from BTC and ETH, to USD stablecoins.

Such rates are commonly seen across CeFi. But in DeFi, prominent protocols can be seen offering even higher yields, such as Anchor Protocol on the Terra ecosystem, a decentralized credit market offering 19.5% annual percentage yield (APY) on TerraUSD (UST). Or consider Notional Finance with a more “modest” 10.5% APY on USD Coin (USDC).

What makes these types of yields possible? How is this different in functionality and risk profile from traditional finance?

Who are the key players in these crypto credit markets? What are the main opportunities?

Adoption and Mechanics

Let’s explore and understand the role of crypto credit markets, their adoption, and their implications.

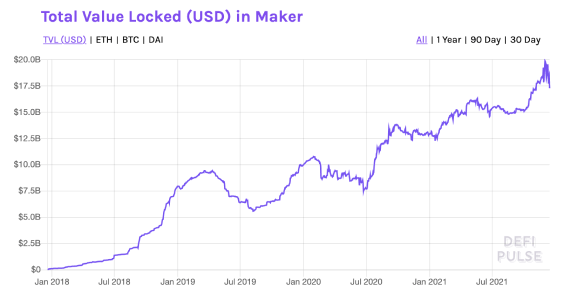

In terms of adoption, MakerDao, the longest established lending and credit market of DeFi built on the Ethereum blockchain, has seen a rise of almost $10 billion in total value locked (TVL) since July 2020 alone, reaching almost $20 billion alone as of December 2021, just in this protocol.

How does Maker work? Maker provides liquidity in the form of a USD-pegged stablecoin, called Dai, to borrowers who are willing to over-collateralize their “unproductive” crypto or USD stablecoin holdings.

Maker is an automated lending market that follows programmatic rules for liquidation, matching lenders and borrowers, and uses smart contracts that allow anyone in the world to audit the financial health of the protocol.

Its real-time loans, balance sheets, solvency, and risks can be viewed by anyone without having to worry whether the data is fraudulent due to innate features of the immutable public ledger that is blockchain.

Any market participant can use the Maker protocol to deposit crypto or stablecoin collateral and generate Dai (USD stablecoin) as debt.

The protocol uses a 140-150% collateralization ratio, with liquidation fees resulting in an algorithmic system to avoid default and maintain the peg of Dai to USD.

For those seeking yields, lending in this market has offered variable interest rates that outweigh much lower rates in traditional finance in exchange for a different risk profile.

To many investors, these rates ranging from 5-8% or even more on USD stablecoins can seem unbelievable given traditional savings accounts yield only 0.1% or less.

Ultimately, what makes these yields possible for lenders is borrowers being willing to borrow at higher rates than lenders are paid; these parties include traders, retail borrowers, and crypto companies.

Crypto Credit Market Participants

Traders (and other participants) borrow at such high rates when they believe they can earn higher returns from trading (or other) activities than the amount paid in interest, which is very possible given the volatility of crypto markets.

There is a market demand for borrowing at these elevated rates given traditional financial institutions do not typically lend to crypto traders or companies. Plus, given the unique market dynamics present in the crypto markets that allow traders to create returns, including arbitrage trades as well as directional and discretionary trades using leverage, there is no shortage of opportunities with which to use the borrowed capital.

Large traders use crypto lenders for significant borrowing needs due to banks’ hesitance to do so due to regulatory uncertainty.

Other parties that participate in crypto borrowing include retail participants who wish to obtain collateral-backed loans (from CeFi or DeFi) on their “unproductive” assets to make purchases or increase leverage further on their exposure while being able to avoid the tax implications of realizing their gains, remaining net long, and taking advantage of the yield and composability of DeFi.

Crypto companies are also borrowers for capital expenditure. CeFi and DeFi services can therefore pay such high yields to lenders because ultimately, there are borrowers willing to pay higher yields.

DeFi’s Key Opportunities

Key opportunities in the credit market involve lending to centralized crypto lending platforms noted above for predetermined interest rates for a specified period. But there are also many opportunities in DeFi including permissionless liquidity mining, yield farming, and more.

DeFi involves the use of smart contracts on the blockchain for anyone to access financial products and services without the need for intermediaries.

DeFi applications of various types include the ability to borrow funds against one’s collateral (MakerDao), deposit funds into liquidity pools for decentralized exchanges (DEXs like Uniswap or Trader Joe on Avalanche network) to be able to function in a peer-to-peer manner, which enable the depositor to earn portions of the trading fees and function as a liquidity provider with one’s assets — this is called liquidity mining.

Another business opportunity is in yield farming, which involves earning interest on deposits to smart contracts. Today there are yield aggregators which enable the end user to obtain the highest yield one desires at varying degrees of risk.

Moreover, because of a concept called composability, many protocols in DeFi function with each other; for example, from the Maker example, once we have Dai (USD) minted against our deposited collateral, we can use that Dai in other smart contracts to earn further yields on it.

Risk Profile

Risk-wise the crypto loans in the modern day are over-collateralized typically by 1.25-3x due to the volatile price of the underlying.

Of course, there are other risks present which are very different from those in traditional finance. This involves protocol risk, smart contract risk, and underlying collateral asset price volatility risk (though not with USD-stablecoin used as collateral), but there are ways to mitigate all of these.

There are also technical and security risks inherent in self-custodying funds in Web3 wallets and transacting in DeFi versus custodying with the traditional finance system, or counterparty risk in using CeFi, especially given the relatively new market we are talking about.

Additionally, in contrast to a bank, there is no FDIC insurance on USD-stablecoin deposits.

Established protocols like Maker are not only audited (though still not a guarantee of safety), but have also withstood the test of time during the crypto bear market of 2018. That was when the ETH collateral saw a 94% decrease in value at its lowest while the system remained healthy and Dai maintained its peg close to $1.

Conclusion

Over time, due to the improving efficiency of the crypto markets, these rates will decrease however borrowing demand continues to increase as DeFi usage and adoption increase.

Notably, the crypto credit markets allow everyone around the world to meet the growing desire for dollars and dollar-denominated debt, in a permissionless and trustless manner which also translates to less overhead and instant settlement (or close), in contrast to traditional finance.

Meltem Demirors, CEO of CoinShares, notes that “the introduction of a robust asset-backed debt market is a game-changer for the crypto ecosystem and many of the companies in it.”

Crypto credit markets are well-positioned to take market share from traditional lending markets, especially as non-crypto companies and individuals with borrowing needs take advantage of the fast-growing infrastructure.

While the crypto credit market is still far smaller in comparison to traditional lending markets, the creation of a new permissionless financial system that is DeFi speaks to the opportunity for this credit market to achieve growth in the coming years. Not to mention that DeFi also brings the ability to provide working capital for companies and individuals.

Eventually, this emergent and new global financial system will reach far beyond traders and crypto users alone, even if its inception may have been born out of necessity for their initial use.

Share this post